New York, USA, Aug. 05, 2025 (GLOBE NEWSWIRE) -- AAV for the Hereditary Retinal Diseases Clinical Trial Pipeline Analysis Demonstrates 70+ Key Companies at the Horizon Expected to Transform the Treatment Paradigm, Assesses DelveInsight

Adeno-associated virus (AAV) is a widely used gene therapy vector for treating hereditary retinal diseases, which are caused by mutations in genes critical for retinal function, such as RPE65, CEP290, or CHM. Many hereditary retinal diseases currently lack effective treatments, creating a strong demand for curative gene therapies like AAV-based interventions. This unmet need positions AAV gene therapies as a transformative solution offering long-term or potentially permanent vision restoration for affected patients.

DelveInsight’s 'AAV for the Hereditary Retinal Diseases Competitive Landscape 2025' report provides comprehensive global coverage of pipeline AAV for the hereditary retinal diseases in various stages of clinical development, major pharmaceutical companies are working to advance the pipeline space and future growth potential of the AAV for the hereditary retinal diseases pipeline domain.

Key Takeaways from the AAV for the Hereditary Retinal Diseases Pipeline Report

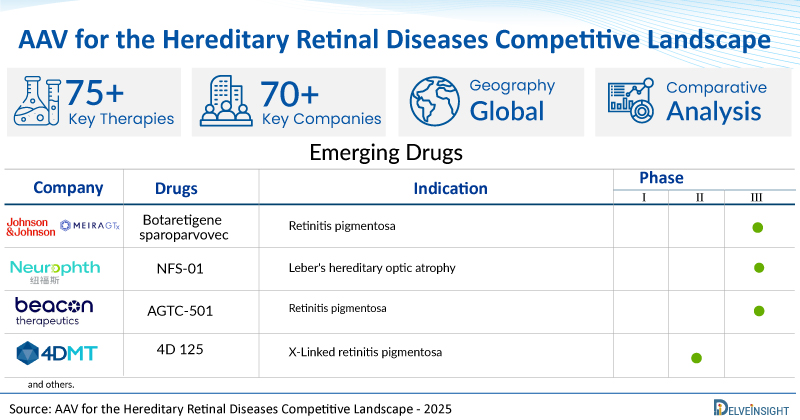

- DelveInsight’s AAV for hereditary retinal diseases competitive report presents a robust market with over 70 active players developing more than 75 pipeline AAV for hereditary retinal diseases.

- Key AAV for the hereditary retinal diseases companies, such as Novartis, MeiraGTx Limited, Johnson & Johnson, Neurophth Therapeutics, Beacon Therapeutics, 4D Molecular Therapeutics, Coave Therapeutics, Ocugen, Atsena Therapeutics, SpliceBio, AAVantgarde Bio, SparingVision, Nanoscope Therapeutics, Ascidian Therapeutics, Inc., Abeona Therapeutics Inc., and others, are evaluating new AAV for the hereditary retinal diseases to improve the treatment landscape.

- Promising pipeline AAV for the hereditary retinal diseases, such as AAV-RPE65, Botaretigene sparoparvovec, NFS-01, AGTC-501, 4D-125, HORA-PDE6b, A007, OCU410ST, ATSN-201, SB-007, AAVB-039, SPVN 20, MCO-010, ACDN-01, ABO-503, and others, are under different phases of AAV for the hereditary retinal diseases clinical trials.

Request a sample and discover the recent advances in AAV for the hereditary retinal diseases drugs @ AAV for the Hereditary Retinal Diseases Competitive Report

AAV for the Hereditary Retinal Diseases Overview

Adeno-associated virus (AAV) is one of the most commonly used vectors in gene therapy for hereditary retinal diseases, conditions caused by mutations in genes vital to retinal function, such as RPE65, CEP290, or CHM. These genetic defects lead to disorders like Leber congenital amaurosis (LCA), retinitis pigmentosa, and choroideremia, which progressively impair vision and may result in blindness. AAV is particularly well-suited for ocular gene therapy due to its low immunogenicity, minimizing immune system activation, and its ability to transduce non-dividing retinal cells like photoreceptors and retinal pigment epithelium (RPE). A single administration can achieve long-lasting gene expression, especially when delivered locally through subretinal or intravitreal injections, thereby reducing systemic exposure.

AAV vectors deliver a functional version of the defective gene directly into retinal cells, most often targeting RPE cells or photoreceptors. Following delivery, the AAV genome remains episomal and utilizes the host cell's transcription machinery to produce the therapeutic protein, effectively restoring the function of the faulty gene. These vectors are non-pathogenic, elicit minimal immune responses, and offer durable gene expression from a one-time treatment.

Future advancements in AAV-mediated gene therapy include the integration of genome editing tools like CRISPR/Cas9, allowing for precise correction of genetic mutations at their source. Innovations such as dual-vector systems and next-generation delivery platforms are helping to overcome the AAV’s limited packaging capacity, expanding treatment options for larger genes. Additionally, researchers are exploring broader, mutation-independent strategies, such as neuroprotection or optogenetics, to benefit patients regardless of their specific genetic mutations. To address challenges related to immune responses, efforts are underway to engineer novel AAV serotypes and synthetic capsids that can evade pre-existing neutralizing antibodies (NAbs). Other strategies include the use of decoy capsids, plasma exchange, or temporary immunosuppression to enable effective re-dosing and broaden patient eligibility.

Despite its promise, AAV-based retinal gene therapy faces several key challenges, including limited cargo capacity (~4.7 kb) that restricts treatment of large genes like ABCA4 and USH2A, immune barriers such as neutralizing antibodies that impact efficacy and re-dosing, difficulties in achieving efficient and targeted delivery to specific retinal cells, especially via intravitreal injection, uncertainties around long-term safety due to limited decades-long data and potential inflammatory risks, and the complexity and high cost of large-scale manufacturing that hampers widespread clinical accessibility.

AAV for the Hereditary Retinal Diseases Market Dynamics

The AAV vector platform has emerged as a transformative modality for treating hereditary retinal diseases (HRDs), offering the potential to restore or preserve vision through targeted gene replacement. These disorders, such as Leber congenital amaurosis (LCA), retinitis pigmentosa, and choroideremia, often result from single-gene mutations and are well-suited for AAV-based gene therapy due to the immune-privileged status of the eye and the relatively small size of target genes. Spark Therapeutics’ LUXTURNA, approved for RPE65 mutation-associated retinal dystrophy, has validated the clinical and commercial potential of AAV gene therapy, paving the way for new entrants and increased investment in this niche but growing market.

Market dynamics in the AAV space for HRDs are shaped by a confluence of scientific, regulatory, and commercial factors. On the one hand, the success of LUXTURNA has accelerated the development of pipelines targeting mutations in genes like RPGR, CHM, and ABCA4. On the other hand, challenges such as AAV’s limited cargo capacity (~4.7 kb), potential immunogenicity, and manufacturing complexity continue to constrain development. Additionally, the ultra-orphan nature of many HRDs means that companies face hurdles in achieving economies of scale, which impacts pricing strategies, reimbursement negotiations, and market penetration.

Despite these barriers, the competitive landscape is evolving rapidly. Numerous biotech firms, including MeiraGTx, Nightstar (acquired by Biogen), and Atsena Therapeutics, are advancing clinical programs, often leveraging AAV serotype engineering or dual-vector systems to expand applicability to larger genes or broader patient populations. Collaborations between biotech firms and larger pharmaceutical players are also becoming more common, as big pharma seeks to de-risk entry into the gene therapy arena by acquiring promising assets or platforms.

Regulatory frameworks are increasingly supportive, with agencies such as the FDA and EMA offering accelerated pathways and orphan drug incentives. However, the need for long-term efficacy and safety data poses a challenge for broad adoption. Payers are also cautiously optimistic, demanding real-world evidence and innovative payment models, such as outcomes-based pricing or annuity payments, to justify the high upfront costs typical of gene therapies.

Looking ahead, market growth for AAV-based therapies in HRDs will depend on technological advances (e.g., novel capsids, improved delivery methods), streamlined manufacturing, and the successful demonstration of durable benefit in larger patient cohorts. As the field matures, there is potential for platform-based expansion beyond monogenic diseases into complex retinal disorders, further reshaping the treatment landscape for blinding eye diseases.

To know more about AAV for the hereditary retinal diseases, visit @ AAV for the Hereditary Retinal Diseases Insights

Approved AAV for the Hereditary Retinal Diseases Drug Profile Analysis

LUXTURNA: Novartis

LUXTURNA is a gene therapy that uses an adeno-associated virus (AAV) vector to treat individuals with confirmed biallelic mutations in the RPE65 gene, which are associated with retinal dystrophy. Treatment is suitable only for patients who have viable retinal cells, as assessed by their physician. Mutations in the RPE65 gene reduce or eliminate the activity of the RPE65 isomerohydrolase enzyme, disrupting the visual cycle and leading to vision loss. By delivering a normal copy of the RPE65 gene into the subretinal space, LUXTURNA enables some retinal pigment epithelial cells to produce functional RPE65 protein, potentially restoring visual function.

Find out more about AAV for the hereditary retinal diseases drugs @ AAV for the Hereditary Retinal Diseases Analysis

A snapshot of the Pipeline AAV for the Hereditary Retinal Diseases mentioned in the report:

| Drugs | Company | Phase | Indication |

| Botaretigene sparoparvovec | Johnson & Johnson/MeiraGTx | III | Retinitis pigmentosa |

| NFS-01 | Neurophth Therapeutics | III | Leber's hereditary optic atrophy |

| AGTC-501 | Beacon Therapeutics | II/III | Retinitis pigmentosa |

| 4D 125 | 4D Molecular Therapeutics | I/II | X-Linked retinitis pigmentosa |

| CTx PDE6B | Coave Therapeutics | I/II | Retinitis pigmentosa |

| OCU410ST | Ocugen | I/II | Stargardt disease |

| A007 | MeiraGTx Limited | Preclinical | Stargardt disease |

Learn more about the emerging AAV for the hereditary retinal diseases @ AAV for the Hereditary Retinal Diseases Clinical Trials

Key Developments in the AAV for the Hereditary Retinal Diseases Treatment Space

- In May 2025, Ocugen received rare pediatric disease designation from the FDA for OCU410ST, an investigational adeno-associated virus (AAV) vector-based gene therapy, for the treatment of ABCA4-associated retinopathies, including Stargardt disease, retinitis Pigmentosa, and cone-rod dystrophy.

- In April 2025, Atsena Therapeutics announced that the U.S. Food and Drug Administration (FDA) had granted Regenerative Medicine Advanced Therapy designation for ATSN-201 for the treatment of X-linked retinoschisis (XLRS).

- In March 2025, SpliceBio announced that it had dosed the first patient in the Phase I/II ASTRA clinical trial, which is evaluating SB-007, a dual adeno-associated virus (AAV) vector-based gene therapy intended to treat Stargardt disease.

- In March 2025, Avirmax Biopharma announced the beginning of Investigational New Drug (IND)-enabling studies of ABI-201, a potential AAV vector that delivers 3 genes to correct the dysregulation of complement activation, anti-inflammation, to protect retinal pigment epithelia and photoreceptors in patients. The potential new drug also aims to block retinal neovascularization.

- In December 2024, ViGeneron GmbH announced that the United States Food and Drug Administration (FDA) had cleared the Investigational New Drug (IND) application for the Phase I/II study of VG801, a potentially transformative gene therapy to treat Stargardt disease and other retinal dystrophies associated with mutations in the ABCA4 gene.

- In August 2024, Opus Genetics received Rare Pediatric Disease designation (RPD) from the FDA for OPGx-LCA5, its investigational ocular gene therapy candidate, to treat patients diagnosed with Leber congenital amaurosis (LCA) resulting from biallelic mutations in the LCA5 gene.

- In July 2024, Charles River Laboratories International, Inc. and AAVantgarde announced a contract development and manufacturing organization (CDMO) agreement to produce Good Manufacturing Practice (GMP) plasmid DNA. AAVantgarde, a clinical-stage biotechnology company with two proprietary adeno-associated viral (AAV) vector platforms for large gene delivery and developing products to treat inherited retinal diseases, will leverage Charles River’s expertise in manufacturing GMP plasmid DNA.

Scope of the AAV for the Hereditary Retinal Diseases Pipeline Report

- Coverage: Global

- Key AAV for the Hereditary Retinal Diseases Companies: Novartis, MeiraGTx Limited, Johnson & Johnson, Neurophth Therapeutics, Beacon Therapeutics, 4D Molecular Therapeutics, Coave Therapeutics, Ocugen, Atsena Therapeutics, SpliceBio, AAVantgarde Bio, SparingVision, Nanoscope Therapeutics, Ascidian Therapeutics, Inc., Abeona Therapeutics Inc., and others.

- Key AAV for the Hereditary Retinal Diseases in Pipeline: AAV-RPE65, Botaretigene sparoparvovec, NFS-01, AGTC-501, 4D-125, HORA-PDE6b, A007, OCU410ST, ATSN-201, SB-007, AAVB-039, SPVN 20, MCO-010, ACDN-01, ABO-503 and others.

Dive deep into rich insights for new AAV for the hereditary retinal diseases treatments, visit @ AAV for the Hereditary Retinal Diseases Drugs

Table of Contents

| 1. | AAV for the Hereditary Retinal Diseases Pipeline Report Introduction |

| 2. | AAV for the Hereditary Retinal Diseases Pipeline Report Executive Summary |

| 3. | AAV for the Hereditary Retinal Diseases Pipeline: Overview |

| 4. | AAV for the Hereditary Retinal Diseases Marketed Drugs |

| 4.1. | LUXTURNA: Novartis |

| 5. | AAV for the Hereditary Retinal Diseases Clinical Trial Therapeutics |

| 6. | AAV for the Hereditary Retinal Diseases Pipeline: Late-Stage Products (Pre-registration) |

| 7. | AAV for the Hereditary Retinal Diseases Pipeline: Late-Stage Products (Phase III) |

| 7.1. | Botaretigene sparoparvovec: Johnson & Johnson/MeiraGTx |

| 8. | AAV for the Hereditary Retinal Diseases Pipeline: Mid-Stage Products (Phase II) |

| 8.1. | AGTC-501: Beacon Therapeutics |

| 9. | AAV for the Hereditary Retinal Diseases Pipeline: Early-Stage Products (Phase I) |

| 9.1. | 4D 125: 4D Molecular Therapeutics |

| 10. | AAV for the Hereditary Retinal Diseases Pipeline: Preclinical and Discovery Stage Products |

| 10.1. | A007:MeiraGTx |

| 11. | AAV for the Hereditary Retinal Diseases Pipeline Therapeutics Assessment |

| 12. | Inactive Products in the AAV for the Hereditary Retinal Diseases Pipeline |

| 13. | Company-University Collaborations (Licensing/Partnering) Analysis |

| 14. | Unmet Needs |

| 15. | AAV for the Hereditary Retinal Diseases Market Drivers and Barriers |

| 16. | Appendix |

For further information on the AAV for the hereditary retinal diseases pipeline therapeutics, reach out @ AAV for the Hereditary Retinal Diseases Therapeutics

Related Reports

AAV Vectors in Gene Therapy Pipeline

AAV Vectors in Gene Therapy Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key AAV vectors in gene therapy companies, including GenSight Biologics, Ultragenyx Pharmaceutical, MeiraGTx, Nanoscope Therapeutics, REGENXBIO, Astellas Gene Therapy, GeneCradle Therapeutics, Asklepios BioPharmaceutical, MeiraGTx, 4D Molecular Therapeutics, Adverum Biotechnologies, Rocket Pharmaceuticals, Innostellar Biotherapeutics, Passage Bio, Aspa Therapeutics, Solid Biosciences, Lantu Biopharma, Ascidian Therapeutics, Decibel Therapeutics, Sio Gene Therapies, among others.

Adeno-Associated Virus Vectors in Gene Therapy Market

Adeno-Associated Virus Vectors in Gene Therapy Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key adeno-associated virus vectors in gene therapy companies, including GenSight Biologics, Ultragenyx Pharmaceutical, MeiraGTx, Nanoscope Therapeutics, REGENXBIO, Astellas Gene Therapy, GeneCradle Therapeutics, Asklepios BioPharmaceutical, MeiraGTx, 4D Molecular Therapeutics, Adverum Biotechnologies, Rocket Pharmaceuticals, Innostellar Biotherapeutics, Passage Bio, Aspa Therapeutics, Solid Biosciences, Lantu Biopharma, Ascidian Therapeutics, Decibel Therapeutics, Sio Gene Therapies, among others.

Gene Therapies In Ophthalmology Competitive Landscape

Gene Therapies In Ophthalmology Competitive Landscape – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key gene therapies in ophthalmology companies, including Spark Therapeutics, Regenxbio, Beacon Therapeutics, Adverum Biotechnologies, Exegenesis Bio, Frontera Therapeutics, HuidaGene Therapeutics, Nanjing IASO Biotherapeutics, GenSight Biologics, Sylentis, Neurophth Therapeutics, Johnson & Johnson Innovative Medicine, Nanoscope Therapeutics, Eyevensys, Atsena Therapeutics Inc., Coave Therapeutics, OCUGEN, INC, Visgenx, Amarna Therapeutics, Ikarovec, Homology Medicines, Ray Therapeutics, Shanghai Refreshgene Technology Co., Ltd., Complement Therapeutics, Abeona Therapeutics, among others.

Retinitis Pigmentosa Market Insight, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the market trends, market drivers, market barriers, and key retinitis pigmentosa companies, including Johnson & Johnson Innovative Medicine, MeiraGTx, Beacon Therapeutics, Nanoscope Therapeutics, Gensight Biologics, 4D Molecular Therapeutics, Coave Therapeutics, Ocugen, Bionic Sight, jCyte, Endogena Therapeutics, ProQR Therapeutics, Aldeyra Therapeutics, among others.

Stargardt Disease Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key Stargardt disease companies, including Kubota Pharmaceuticals, Nanoscope Therapeutics, Alkeus Pharmaceuticals, Belite Bio, Astellas Pharma, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences.

Connect with us at LinkedIn

Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com